Silicon Valley’s The Hundred dream: Stake at Lord’s today, maybe owning Virat Kohli tomorrow

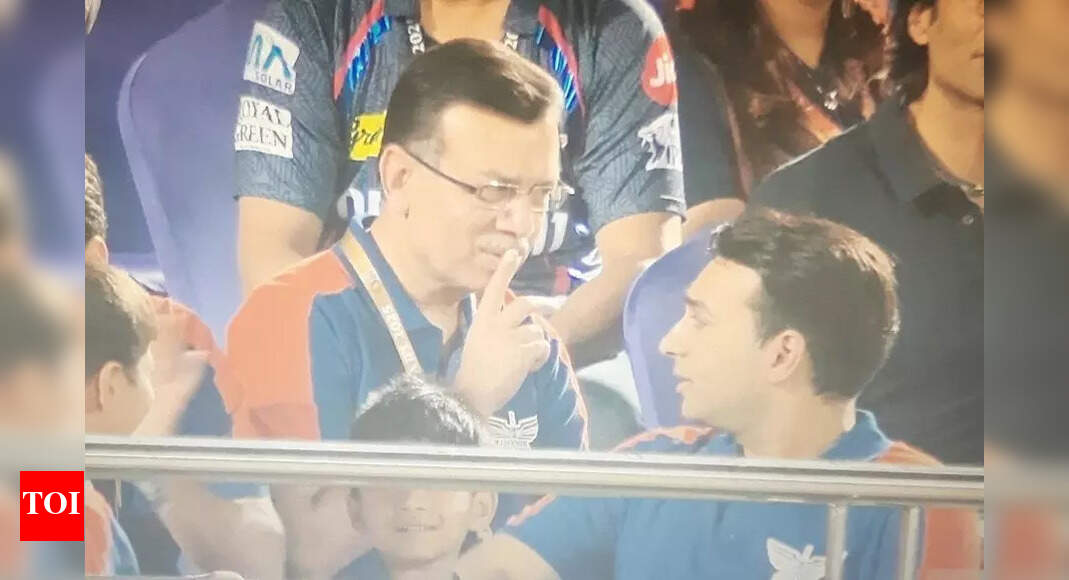

Growing up in Hyderabad, the bedroom wall at Microsoft chief executive officer Satya Nadella’s home had three posters that probably would have never been pasted together. Alongside philosopher Karl Marx and Goddess of wealth Lakshmi was good-looking batsman ML Jaisimha, a long-time favourite cricketer among the game’s connoisseurs. In an old interview, Nadella has also spoken about missing the heady days of Sachin Tendulkar’s debut as he moved to the United States in 1988.Another desi corporate czar in the US, Nikesh Arora of cyber-security company Palo Alto Networks, recently said how he and his other Silicon Valley friends, most Fortune 1000 regulars with Indian roots, get up at 4 am to watch the Indian Premier League. They would tune in for Tests too. At the height of the anti-trust law debate in 2021, Google CEO Sundar Pichai would find time to follow Rishabh Pant’s daredevilry in Brisbane. “One of the greatest Test series wins ever…” – he would tweet.It isn’t just cricket but also the longing to reconnect with their childhood passion in the land of baseball that brings most Indians together – even business rivals. Last week, 11 Indian-American cricket romantics got the right to be called part-owners of the Home of cricket – the iconic Lord’s cricket ground in London. The privilege to be the first-ever private partners at Lord’s in more than 200 years came at a price – 144 million pounds. Converted into rupees, the amount makes Indian eyes water – Rs 1,500 crore.Story continues below this adThe opportunity arose when the England and Wales Cricket Board (ECB) decided to auction 49 percent of the eight teams playing ‘The Hundred’ – the contest for supremacy in cricket’s latest variation, the four-year-old barely breathing format in need of a cylinderful of fiscal oxygen.This opened the door to some exclusive cricket clubs. Silicon Valley cricket enthusiasts wouldn’t have missed this chance. It was just a minority stake of ownership for one tournament with no rights or say in anything else. It was still worth it, it seems.This rare chance saw the coming together of a consortium that can pass off a corporate Dream Team. Called Cricket Investor Holdings Limited, this group, headed by Palo Alto’s Arora, has Pichai and Nadella along with CEOs of Adobe and Silver Lake Management – Shantanu Narayen and Egon Durban. Also part of the consortium is Satyan Gajwani, vice-chairman of Times Internet.Putting in own moneyMind you, these are individual investments of high-profile cricket enthusiasts with no involvement of the institutions they work in. The names of other investors in the consortium haven’t yet been made public.Story continues below this adAlong with these American NRIs, there will be several other Indians enjoying ownership status at iconic English grounds this The Hundred season. Is this the start of the Indian takeover of the English game in England?From the onset, it was a no-brainer that those who threw their silk hats, or kitchen sink, at the auction had their eyes on the two London clubs – London Spirit and Oval Invincibles. Also up for grabs were teams based in Leeds, Birmingham, Manchester, Southampton, Nottingham and Cardiff but they couldn’t beat Lord’s, Oval or London.While the Silicon Valley deep pockets swooped the jewel of the crown for an astronomical amount, the other London venue, the Oval, became the new home of the Reliance Industries-backed global cricketing behemoth Mumbai Indians.In what is being called a steal, MI paid half of what the Silicon Valley consortium shelled out. For 60 million pounds – about Rs 650 crore – they got a London team with the most successful The Hundred record, and a tie-up with a county that has a better balance sheet than Lord’s. Plus a much larger stadium too.Story continues below this adWith MI aiming to be a multi-team global franchise, this was a ‘must buy’ auction. And so it was for IPL’s newer owner Sanjeev Goenka of the Lucknow SuperGiants. He shelled about Rs 885 crore to be at Old Trafford as the majority owner of Manchester’s Originals. Goenka got 70 percent as Lancashire became the first county to part with its own share.IPL side Sunrisers Hyderabad would make the biggest splash. On Wednesday, they became the first team to own 100 percent of a Hundred side. They reportedly paid Rs 1100 crores for Northern Superchargers, the Yorkshire franchise. Welsh Fire, the Cardif franchise, too has an Indian investor in former IBM employee and IT magnet Sanjay Govil for about Rs 437 crore.Method, not madnessDoes this mean that Lord’s new partners, the Silicon Valley investors, went overboard in forking out Rs 1,500 crore? Were they blinded by their passion or the dream to be part of an incredible legacy? Those in the know say that it is foolish to question the spending of a group of business tycoons known for their vision of the future.“This is not a P&L (Profit and Loss) game, this is all about valuation. This is a strategic investment, you are putting your money in cricket, how can you miss out on England? It’s where every innovation has started,” a source says. But in a world where T20 rules, was The Hundred the wrong horse to back? Though the MoUs remain classified and dots not placed on i’s and t’s yet to be crossed, the grapevine has it that nothing is etched in stone.Story continues below this ad“It can start as The Hundred but things can always change. It can one day become a T20 tournament since it’s the most popular format. The investors have paid a lot, their voice will be important,” said someone in the know.But can yet another T20 league be a game-changer or worthy of a hefty investment since there are so many around the world? Even Indian T20 investment isn’t unique – most IPL teams are part of leagues in South Africa, USA and the Emirates. Silicon Valley bigwigs are also bankrolling Major League Cricket – so even that isn’t new.The big reason for IPL being the undisputed global flagship limited-over franchise tournament is the presence of Indian megastars. So far, BCCI has guarded its monopoly stringently, they haven’t allowed their players to venture to other leagues. It is only after a player retires and is not part of the IPL that he gets a chance to play in other leagues. Wicketkeeper Dinesh Karthik turning up for Rajasthan Royals’ Paarl Royals outfit in the SA20 is the latest example.With few of India’s top stars in the last phase of their international careers, The Hundred’s Indian investors see a glimmer of hope. “Now that there are owners with hefty funds, India’s superstars can be wooed to play in England. This league is also during the time when there is monsoon in India and it’s off-season,” says the source before the nudge and wink comment. “Virat Kohli has moved to London, hasn’t he?”Story continues below this adFor the American billionaires who have watched cricket from a distance, what’s Rs 1,500 crore for a chance to be owner of a team that has Virat Kohli?Lord’s @ 49%: Rs 1500 cr; Leeds @ 100%: Almost Rs 1100 cr* A Silicon Valley consortium of mostly investors with Indian roots, headed by Nikesh Arora of Palo Alto Networks, now has 49 percent stake in Lord’s-based The Hundred franchise London Spirit. They paid about Rs 1,500 crore.* Others part of the Cricket Investor Holdings Limited are CEOs Sundar Pichai (Alphabet), Satya Nadella (Microsoft), Adobe (Shantanu Narayen), and Silver Lake Management (Egon Durban). Satyan Gajwani, vice-chairman of Times Internet, too is part of the consortium.* In a steal, Mumbai Indians paid about Rs 650 crore to be the stakeholders of the other London franchise – Oval Invincibles.Story continues below this ad* Sanjeev Goenka of Lucknow SuperGiants became the majority owner of Manchester Originals. He paid Rs 885 crore. Welsh Fire, the Cardif franchise, too has an Indian investor in IT magnet Sanjay Govil for about Rs 437 crore.* Yorkshire, based at Headingley in Leeds, sold its entire stake in the Northern Superchargers franchise to the Sun Group, which owns IPL team Sunrisers Hyderabad for about Rs 1,093 crore.